COOKIES DISCLAIMER

We use essential cookies to make our site work. With your consent, we may also use non-essential cookies to improve user experience and analyze website traffic. By clicking “Accept” you agree to our Disclaimer and Privacy Notice.

DBOS is a wholly Sarawak-owned development financial institution set up with a mandate to fund strategic projects aim at transforming Sarawak into a high and advanced economy to support Post COVID-19 Development Strategy (PCDS) by 2030. The Bank was incorporated in May 2017 and came into operation in January 2018.

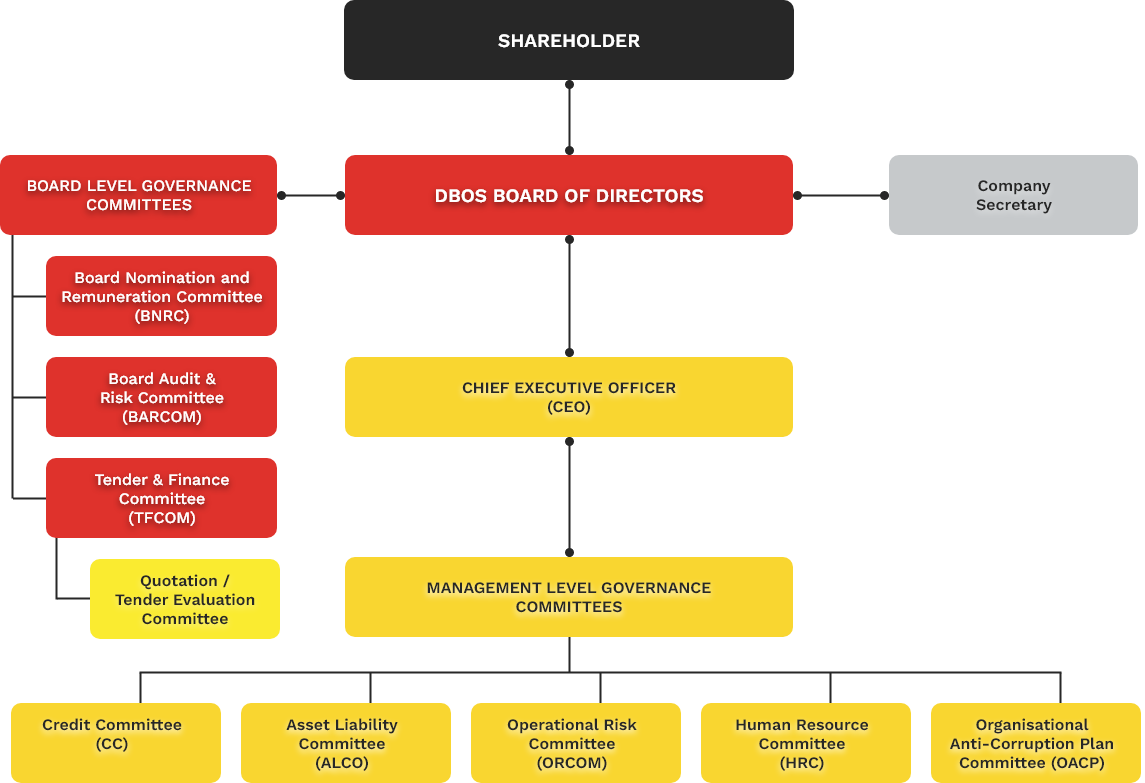

DBOS commits and adheres to the best practices of corporate governance inclusive of applicable governances regulations as introduced by Bank Negara Malaysia and Securities Commission Malaysia. This approach has been adopted notwithstanding the fact that DBOS is a non-prescribed development financial institution.

DBOS has adopted various initiatives which enable its Board of Directors (“Board”) and Senior Management to make well-informed decisions, provide appropriate accountability and transparency, and establish proper culture and behaviours.

The Board is committed to cultivating a responsible organisation by ensuring excellence in corporate governance standards at all times and in this respect, the Board has proceeded to:

| Code of Business Ethics | LEARN MORE |

| Organisational Anti-Corruption Plan (OACP) | LEARN MORE |

| Anti-Bribery and Corruption Framework | LEARN MORE |

|

Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities (AMLA) Policies and Procedures

|

LEARN MORE |

|

Complaint Management Policy

|

LEARN MORE |

| Personal Data Protection Policies and Procedures | LEARN MORE |